PERSONAL INJURY PROTECTION: WHAT YOU MUST KNOW

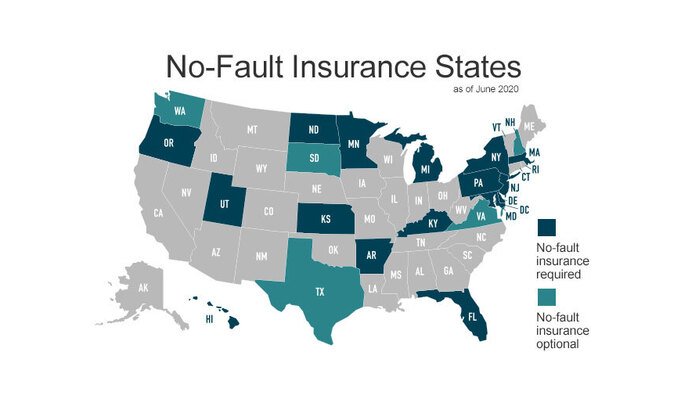

Personal injury protection (PIP) is a form of car insurance meant to cover expenses like medical bills, lost wages, and even funeral costs, no matter who is at fault. It really is an important component of auto insurance that many people are unaware of. You might even already have it and not even know. This type of coverage is offered in 17 states, and only 12 of those states require all drivers to carry the minimum amount of personal injury protection.

KEY THINGS TO KNOW ABOUT PIP

The minimum amount of personal injury protection coverage that your insurance company is required to offer is $2,500, even though many companies tend to offer higher than that. Meaning if you didn’t reject the coverage in writing, it is safe to say you have at least $2,500 in coverage. However, this form of auto insurance is required in 12 states, and these are their minimum requirements:

Five states in addition to Washington, D.C., offer personal injury protection as an optional add-on, and if you do not want to add it, you are given the option to waive it in writing. Following an accident PIP funds can be accessed quickly. Once you are to receive a medical bill, you can submit the bill for payment by PIP. They should either pay the provider directly or send the check to you within a 20-day period. This quick turnaround time can help you stay out of any financial trouble.

-

Delaware- $15,000

-

Florida- $10,000

-

Hawaii- $10,000

-

Kansas- $4,500

-

Massachusetts- $8,000

-

Michigan- Requirements vary

-

Minnesota- $40,000

-

New Jersey- $15,000

-

New York- $50,000

-

North Dakota- $30,000

-

Oregon- $15,000

-

Utah- $3,000

Whatever it is, the way you tell your story online can make all the difference.

HOW PIP INSURANCE WORKS

In order to obtain personal injury protection insurance, you must seek medical treatment within 14 days of the accident. Here it is important to seek medical attention even if you do not feel injured initially, because injuries can sometimes present themselves later. Under the PIP statute, the medical treatment needed to initiate the insurance may be provided by an M.D., D.O., dentist, hospital, emergency medical personnel, or a facility owned by a hospital.

Typically, PIP insurance pays for 80% of the medical bills that arise as a result of the accident, 60% of any lost wages, with a cap at $10,000 depending on the classification of your injuries. Policies do differ so it is important to speak with your insurance agent or even an attorney to find out what policy you have in place.

Majority of the states that require PIIP are no-fault states. The alternative to these insurance laws is a tort system for paying claims for medical expenses. In tort states, there aren’t any restrictions on the right to sue. Two tort states also require drivers to obtain PIP insurance. If your accident occurs in a tort state, PIP insurance provides you immediate benefits to the people that were injured in your vehicle, including yourself. However, it does not and cannot limit anyone’s right to sue you if you are at fault for the damage caused.

WHAT EXACTLY PIP COVERS

Medical expenses. Covered medical expenses include ambulance services, medical and surgical treatment, hospital stays, nursing, medication, medical supplies, X-rays, prostheses, rehabilitation, dental care, optical treatment and even chiropractic services. In some states medical expenses will be reimbursed at less than 100 percent, which leave the consumer responsible for up to 20 percent coinsurance.

Funeral expenses. If a life is lost due to the events that occurred, your funeral expenses can be covered under this insurance. These expenses can include funerals, burials, and cremations.

Lost income. If either you or another passenger is unable to work due to the injuries sustained, PIP can help you recover some of those wages. Even if you are self-employed and must hire substitute employees, some of these costs can be covered too.

Childcare expenses. If your injuries make it impossible to properly care for your children, you can receive coverage on certain childcare expenses like hiring a temporary babysitter or nanny.

Household services. PIP could potentially cover lawn or house care needed if your injuries make you unable to perform them. The amount of coverage varies by state and insurance company, but you could be protected up to the policy’s limits after any deductibles.

WHAT PIP DOESN’T COVER

-

Damage to your car

-

Damage to other people’s property

-

Injuries to other drivers involved in the accident

-

Injuries from accidents that occur while a covered driver is using their car to make money, such as ubering.

-

Injuries from accidents that are intentionally caused

-

Injuries resulting from accidents that occur while the covered driver is a committing a crime, like fleeing the police, or a hit and run

-

·Injuries that were caused by an uninsured car owned by you or an immediate family member

PIP VS. LIABILITY INSURANCE AND MEDPAY

Personal injury protection pays for you medical care regardless of if you are at fault for the accident or not. Liability car insurance, however, pays for injuries or damages that you could potentially cause to others. Liability insurance does not pay for your injuries or for damage to your property. Auto liability insurance is also required in more states than personal injury protection. Medical payments coverage, or MedPay, pays for medical expenses from crash-related injuries regardless of fault too. However, it does not offer the additional benefits that PIP does, such as covering lost wages, funeral costs, childcare or housecleaning expenses.

DO YOU NEED PIP INSURANCE

Well, you do if you live in one of the mentioned states that require you to have it, unless it is optional, and you can reject the coverage in writing. Even if it isn’t required, having personal injury protection is a good idea because it can pay for expenses that your health insurance may not. Florida drivers are required to have the Personal Injury Protection insurance included in their car insurance policy, even if you only decide to go with the minimum.