Disney World’s Property Damage Dilemma

Few places around the world promote dressing like a duck named Donald, or having a conversation with a dog named Goofy. Walt Disney World is one of those places. It seems like year after year, Disney World expands its reach, often without acquiring more land to do so. Disney World isn’t only a place to experience childhood nostalgia; it’s the place that encourages each and every guest to fall in love with the characters and, ultimately, their home, Disney World (or Disney Land). Maybe that love is as apparent in a movie like “Lady and the Tramp,” or… it could be disguised in something like “Rogue One,” where hope is the gateway to love for the story’s characters. Most of us will never truly understand the commitment, time, money, effort, imagination, and dedication it takes for such a place to stay open 24 hours per day, seven days a week, 365 days a year.

The Orlando theme park has only officially closed three times since its grand opening in 1971. Personal feelings about the park aside, that is amazing, and in this day and age, it’s completely unheard of. That’s not to say they haven’t had their share of challenges in maintaining the property, especially Epcot, the oldest member of the Disney family’s theme parks.

South and Central Florida are commonly known to be hotspots for hurricane season and the hurricanes that come with it. Disney, while slightly tucked inward of Central Florida’s peninsula, the park(s) are still susceptible to the annual hurricane or tropical storm. As recent as last week, “Living with the Land” of Epcot has experienced severe setbacks due to heavy rains and wind damage. As Inside the Magic reported, “the attraction and the Land pavilion as a whole were damaged during the recent storms and flooding.” Even when there isn’t a hurricane there still can be damage, as most Florida residents are all too familiar with.

What is not as common is a smooth or swift recovery from storm or hurricane damages. We’ve found more often than not, insurance companies will try to undervalue or even outright deny damage to Florida homeowners and residents. The best practice to address this concern is to employ a professional litigator to aggressively argue a fair and just settlement for you. The Fischetti Law Group is comprised of the very best in paralegals, administrators and litigators to best serve you and/or your family when dealing with property damage insurance claims.

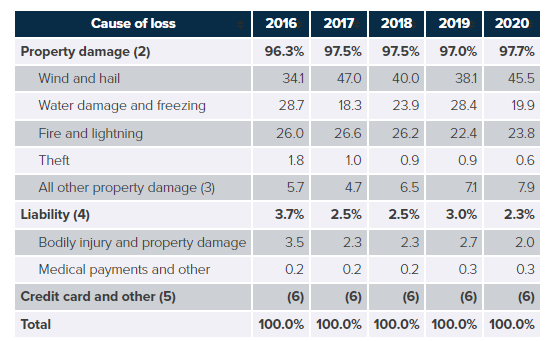

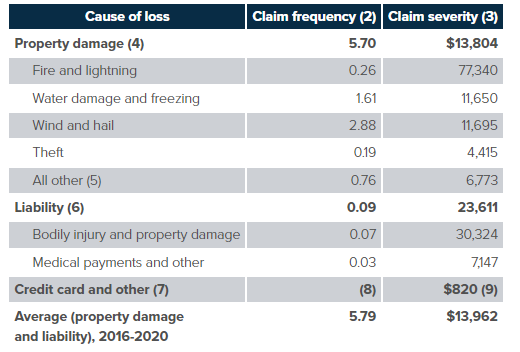

The graphic above shows the frequency per every 100 homes that need to file a homeowners or renters insurance claim (keep in mind that roughly 97% of all insurance claims represented are property damage claims). We have also provided the average cost of repair per claim under the “claim severity” column. Show to the right is the percentage of property damage and liability. Without proper legal counsel to litigate, many renters and homeowners have to pay for some or even most of the repairs.